32+ Snowball loan payment calculator

At payment 7 what is left is applied to debt 2. When a balance paid off add its monthly payment to your next debts payment.

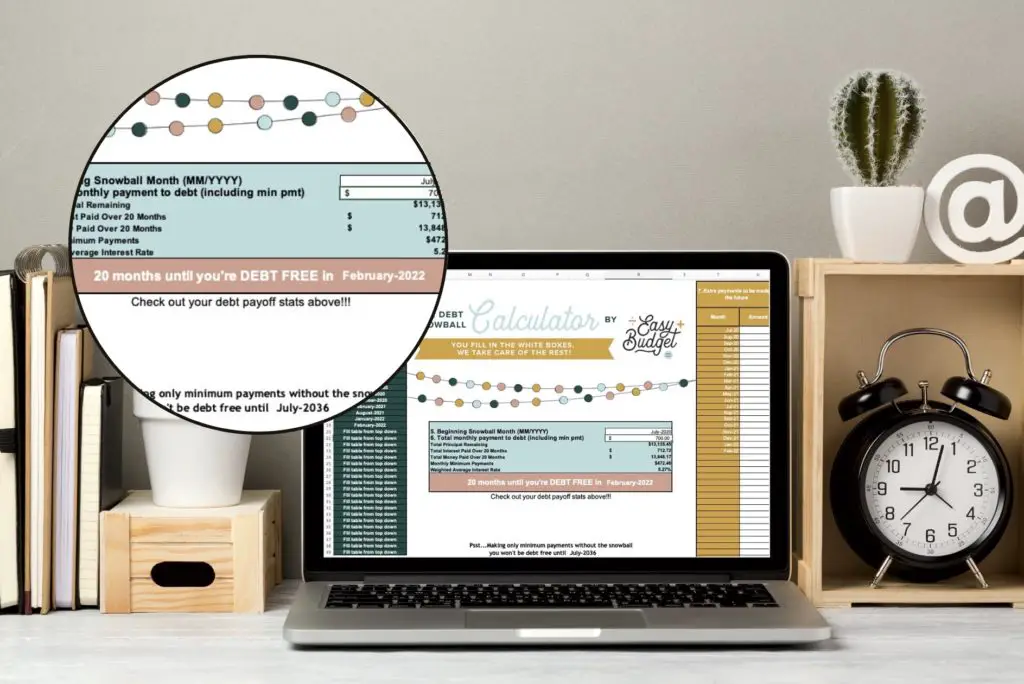

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

Input your current debts including balances interest rates and minimum.

. Put in the minimum payment. To set you up for success here are some of the best free debt snowball spreadsheets. Debt Snowball for Google Sheets by Tiller Community Solutions.

You just fill in the creditor balance owed interest rate and your monthly payment information for each. This dollar amount is in addition to your monthly minimum payments that you will use to pay down your debt. When a balance is.

Weve made starting the debt snowball simple by creating this easy-to-use calculator. Using the debt snowball calculator is super easy. As you use the calculator keep the following in mind.

Plug in your debt details. Notice in the above example that the extra is added to the payment for debt 1. Loan Calculator With Extra Payment.

It will list whatever you list as number 1 first in the snowball. You have the option to use an. The name of the lender.

Add each form of debt that you haveexcluding mortgageswith the account type remaining balance interest rate and minimum payment due each month. The higher this amount the faster your debt will be paid off. Our Debt Snowball Calculator can make organizing your debt simple.

Student Loan Snowball Calculator 32 Debts Student Loan Debt Snowball Excel Template Student Loan Payoff Calculator Student Loan Debt 999. First things first enter all your debts into the debt snowball template. Find the best rates for your dream machine.

Input the interest rate and how much you currently owe. How to use this calculator. Pay off your highest interest rate first.

This calculator is intended solely for general informational purposes and to provide a. Just follow these three steps. Pay off your highest interest rate first.

A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future. When a balance is paid in full apply. Give each entry a name such as the loan company or credit cards.

The calculator will ask you for. Snowball Debt Elimination Calculator applies two simple principles to paying off your debt. This spreadsheet lays it all out.

We built this debt payoff calculator to help people eliminate their debt once and for all. Start with your smallest debt and insert it on the far left. Change Debt 1 to your debt title like Amex.

The Snowball Debt Elimination Calculator applies a simple principle to paying off your debt. You start by inputting all of your current debt information. Snowball Debt Elimination Calculator applies two simple principles to paying off your debt.

Loan calculator with extra payments is used to how early you can payoff your loan with additional payments each period. With the debt snowball method you. The Snowball Debt Elimination Calculator applies a simple principle to paying off your debt.

Figure out your monthly payment with the calculator below. Snowball Debt Elimination Calculator. When a balance paid off add its monthly payment to your next debts payment.

32 The Top Small Bedroom Ideas For Couples Bedroom Bedroomideas Bedroomdecor Bedroomdesign Hauptschlafzimmer Schlafzimmer Wohnen

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

Home Remodel Budget Excel Template Home Renovation Budget Etsy Canada Excel Budget Template Excel Budget Budget Remodel